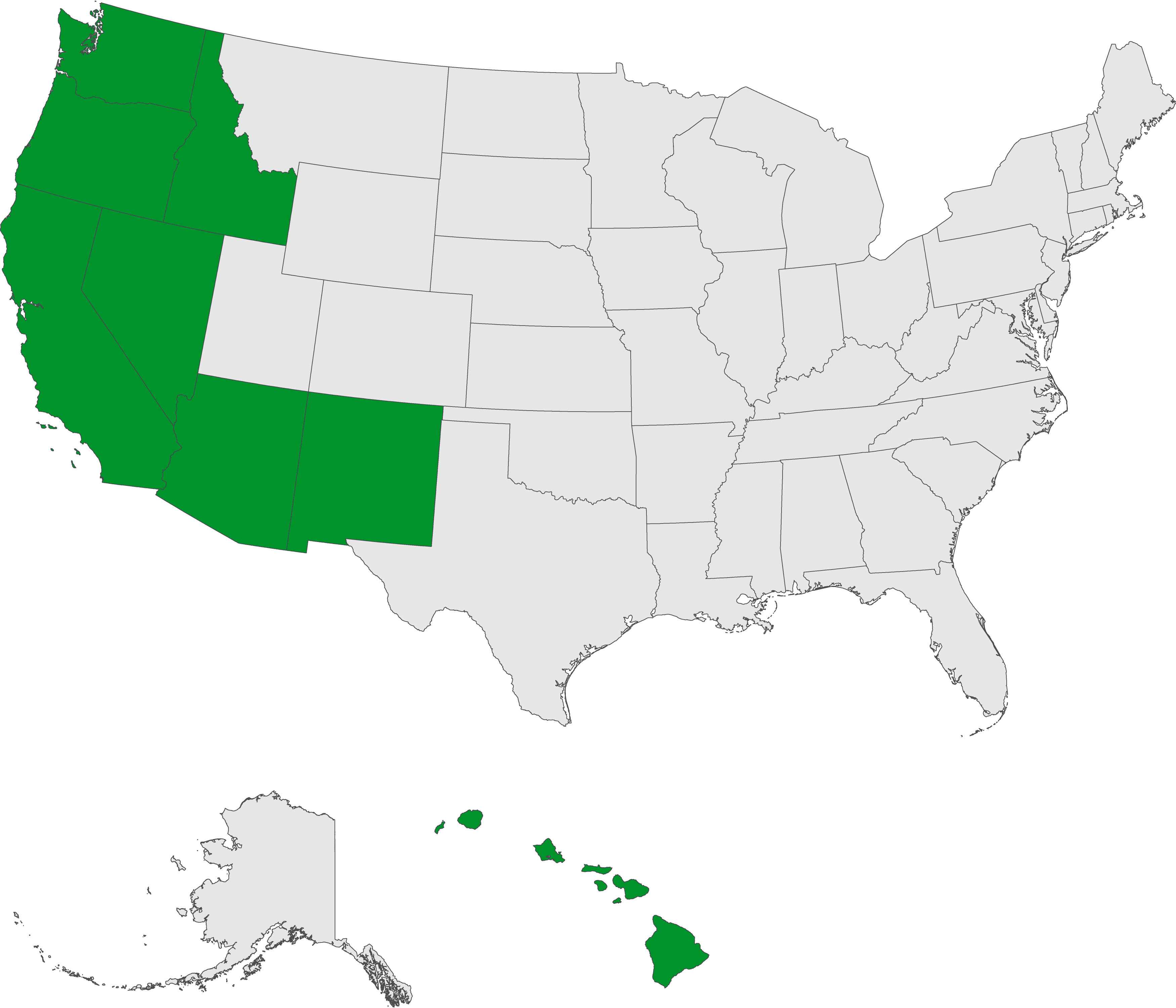

Explore Our Licensing Coverage

Where Greenbox Loans, Inc. is Approved to Serve You

Greenbox Loans, Inc. proudly provides mortgage services across numerous states. The map below highlights our approved states, where we can assist with your mortgage needs. Whether you’re in a fully approved state or an investment property exempt state, we’re here to help. Please review the map and legend to understand our service areas and any state-specific conditions.

Legend:

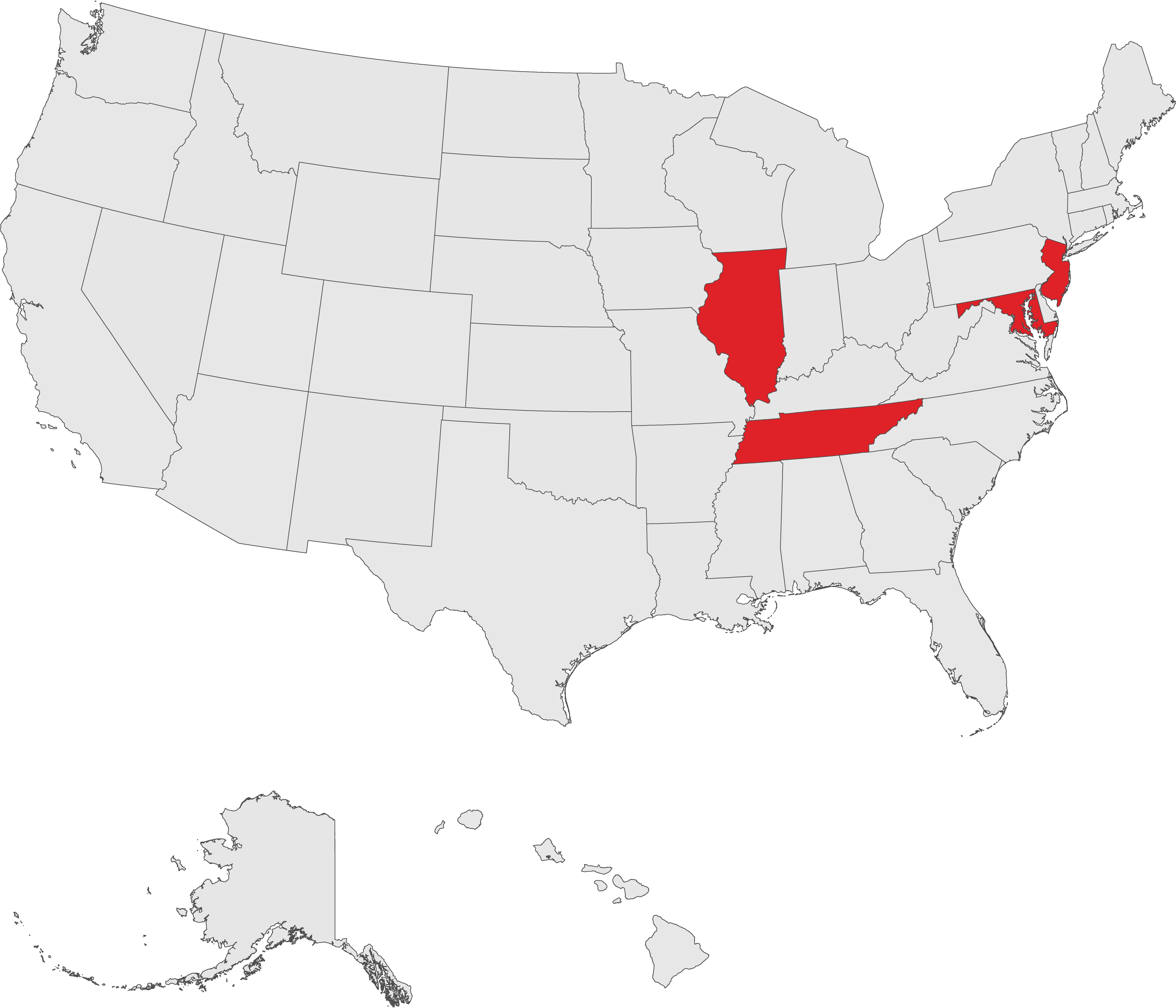

Explore Dry and Wet States

Dry vs. Wet State

Funding Map

Explore the interactive map to discover which states operate under wet funding or dry funding rules in the Non-QM lending process. Wet states disburse loan funds immediately upon signing, while dry states ensure all documents are recorded before releasing funds. Hover over each state to learn more about its specific funding requirements and how it impacts your mortgage transaction.

Legend:

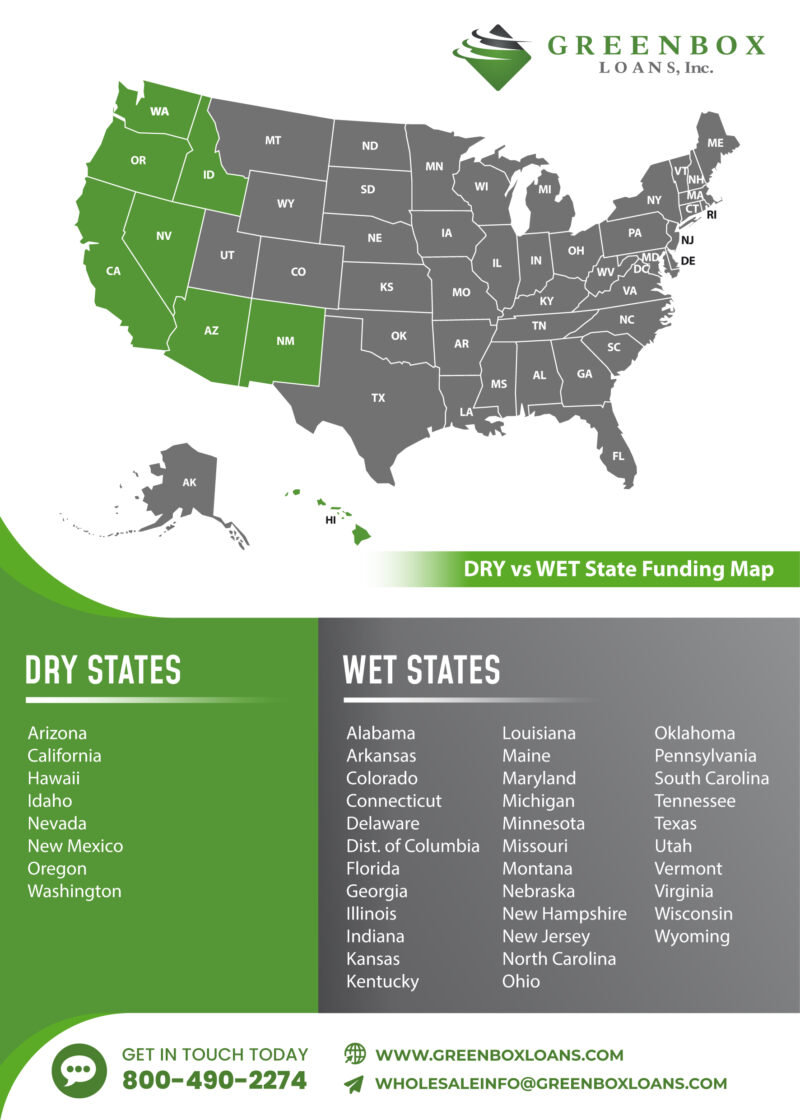

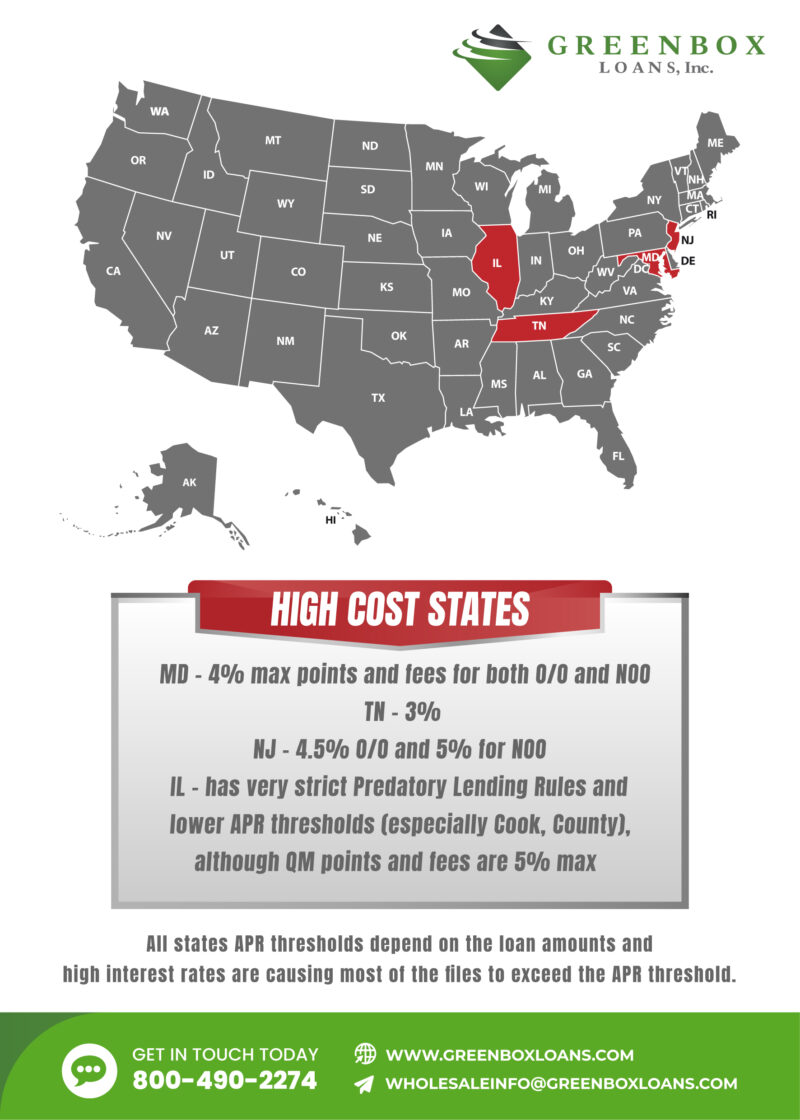

Explore High-Cost States

Mapping High-Cost States

This map highlights the high-cost states within the Greenbox Loans portfolio. These states have specific regulatory considerations that can affect loan limits and pricing. Use this map as a quick reference to see which states are classified as high-cost and consider how this might influence your lending strategies.

Legend:

* All states APR thresholds depend on the loan amounts and high interest rates are causing most of the files to exceed the APR threshold

Greenbox Loans Inc. NMLS #333659

Licenses

| State | License # |

|---|---|

| Arizona | 0919899 |

| California | DFPI 603L516 |

| California | DRE 01300944 |

| Colorado | 333659 |

| Florida | MLD886 |

| Georgia | 33937 |

| Hawaii | 333659 |

| Illinois* | MB.6760993 |

| Louisiana | NMLS #333659 |

| Maryland | 21707 |

| State | License # |

|---|---|

| Massachusetts | ML333659 |

| Minnesota | MN-333659 |

| Nevada | 4791 |

| New Jersey | 333659 |

| North Carolina | L-156181 |

| Oregon | 333659 |

| Pennsylvania | 48972 |

| Tennessee | NMLS #333659 |

| Texas | 333659 |

| Utah | 333659 |

| Virginia | MC-6781 |

| Washington | CL-333659 |

| Wisconsin | 333659BA |

* Illinois Residential Mortgage Licensee No. MB.6760993 – Licensed by the Department of Financial and Professional Regulation, Mortgage Banking Division, 555 West Monroe Street, 5th Floor, Chicago, IL 60661, (888) 473-4858 (www.nmlsconsumeraccess.org)

Disclosures

CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550.

THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV